Sneaky taxes…. Are you at risk?

IRMAA stands for Income Related Monthly Adjustment Amount and is a surcharge, or “sneaky tax”, that high income earners pay on Medicare Part B and D premiums.

IRMAA often snares unwitting participants whose income had a temporary spike and pushed them into surcharge territory.

Who is impacted? Unfortunately, we often see those affected by IRMAA not as wealthy retirees with generous pension benefits or outsized investment portfolios, but those who worked hard and saved for retirement using common retirement strategies.

These include:

- Tax advantaged accounts (IRAs, 401ks, etc.)

- Real estate liquidations.

In both cases, deferring taxes for too long could result in large Required Minimum Distributions (RMDs) or large capital gains, pushing investors into higher thresholds, thus triggering the surcharge.

The figure that determines who pays, and how much, is called Modified Adjusted Gross Income, or MAGI.

MAGI is essentially Adjusted Gross Income with some otherwise allowable deductions added back.

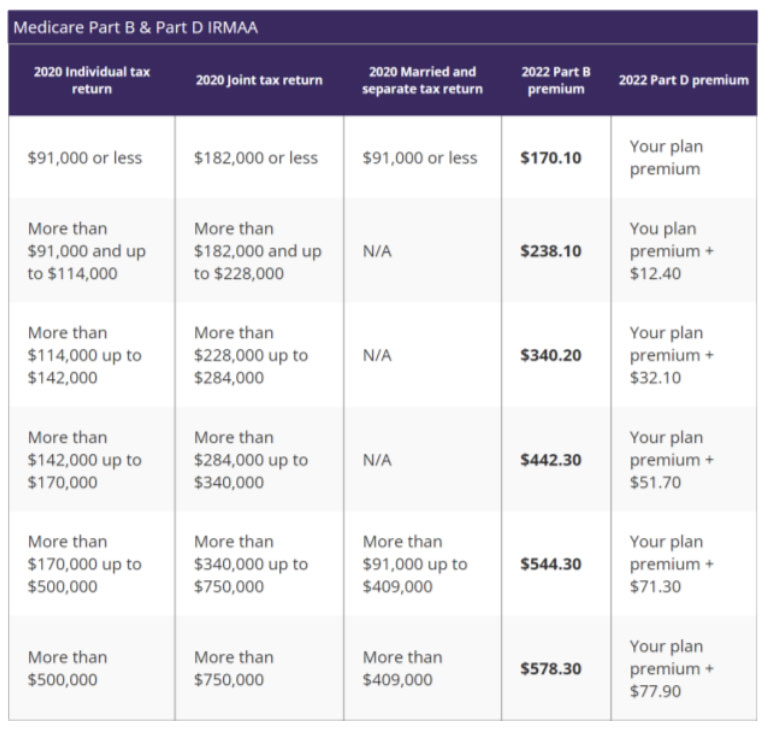

The standard Premium for Medicare Part B in 2022 is $170.10 per month for each covered participant.

However, there are 5 additional price thresholds that apply as income levels rise. Keep in mind that the surcharge is monthly and applies to each person.

How are premiums calculated?

The Social Security Administration (SSA) is responsible for IRMAA and relies on the Internal Revenue Service (IRS) to provide income data to determine where adjustments apply.

New rates are set in the fall and go into effect in January. The Social Security Administration must rely on tax returns from 2 years prior, due to the lag in the available income data, to set the new rate. This is particularly important to understand if you were to retire in the interim because a substantial drop in income might exempt you from IRMAA.

Letters are sent to covered participants in Autumn to provide advance notice of how premiums might change. You have access to an appeals process for cases where a life event, such as retirement or loss of pension benefit, warrants a review that may impact what you actually pay.

However, given the low level of awareness and transparency as to how all this works, many clients are not aware, resulting in potential missed opportunities to remedy a temporary situation.

Understanding these machinations might influence a more strategic plan for withdrawals from tax deferred retirement accounts or using them for charitable giving. It might also shape the timing of a sale where large capital gains will be produced or encourage strategies to mitigate them.

This is often an unexpected event, but can be addressed with proper planning.

Contact Sage Wealth Planning to learn if you may be subject to IRMAA, and ways to mitigate this risk as part of your planning strategy.